Content

Many artists are their own DIY accountant, but some might be curious to see what options exist to bring in the professionals. FreshBooks accounting software for artists will help. If you’re a business owner, you are building a business, I don’t want it to take you by surprise. From the very beginning, you should be setting aside a percentage of the sales that you make for taxes. Just as in tracking your income make sure that the receipt shows the date of the expense, description of purchase, form of payment, amount of expense, sales tax charged on the expense and reason for purchase.

What is an artist accountant?

Also Called. Entertainment Accountant, Music Business Accountant. Arts and entertainment accountants advise both individual artists and arts-related businesses on financial matters.

Gain insights that’ll take your business to the next level. Pentacle remains dedicated to continuing to provide a high level of support to artists during these extraordinary circumstances. In order to prepare the IRS income tax records, it is necessary to keep track of a number of non-art income and expense items. A gallery contains a lot of expensive stuff, so of course the inventory insurance on the artwork is also very high.

Why Is It Important to Keep Track of Artists and Musicians Accounting?

In that calculator, you can put all of your products. You just enter a few numbers, and then it will tell you your percent of the profit from every product. When I started reading that book, I realized I actually knew more than I thought I knew.

However, about 15% of the galleries generate more than $1 million of revenue per year. These galleries are in the sweet spot of the industry, because they’ve been able to attract the best artists, whose works sell for a lot more money. These perks come in cashback or cash credits, shopping vouchers, complimentary travel insurance, air miles, waived foreign currency charges, and more. There are arts-specific accounting and financial services available to help you focus less on accounting and more on your creative practice. Some are meant to be used by individuals, some by organizations.

Tools for Record Keeping

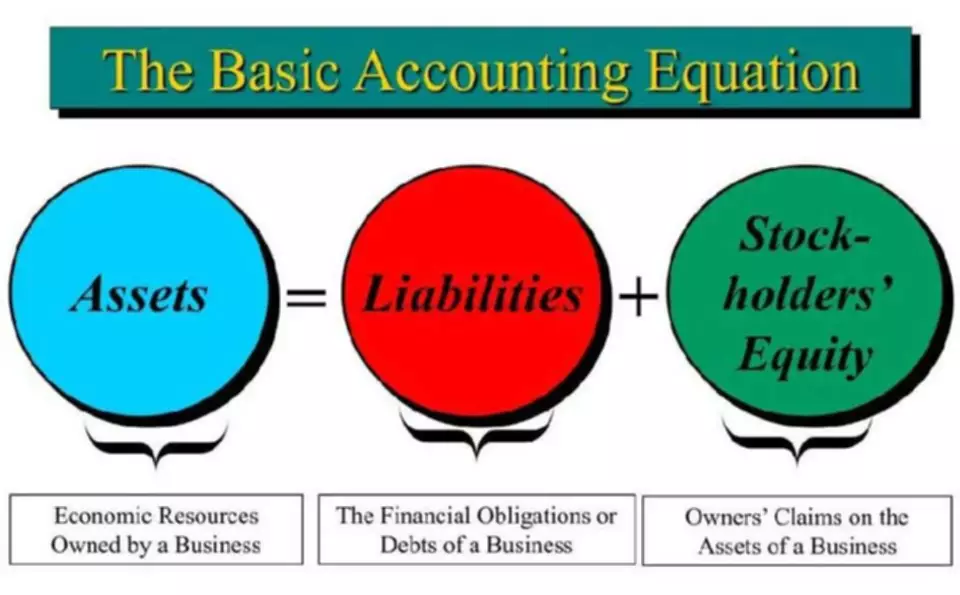

The North Carolina Center for Nonprofits works with the NC Association of CPAs to offer pro bono services to its members. You don’t have to fear to look at the numbers in your accounting for artists art business. Having the know-how of the accounting basics for artists is a great tool for you to understand your business better and to create a better art business plan.